How I Paid Off My $52,335.76 Student Loan Debt

10 years ago I graduated from a private college with my BFA and $35,384 in student loans. Young and fresh out of college I thought it was not that big of a deal. I was just happy and relieved to no longer be doing all-nighters and driving to and from classes. My graduation ceremony was on a Thursday in May and I had previously already lined up a few solid job offers prior to graduation day, so that following Monday I reported straight to my new job! So far, so good.

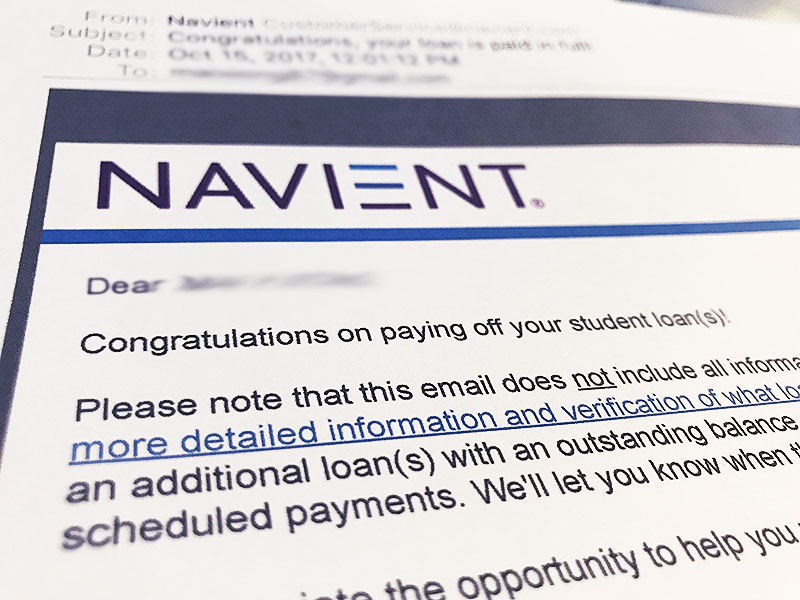

10 years later, my loan amounted to $52,335.76 with interest. My loan went from $35,384.44 in 2007 to a grand total of $52,335.76. That’s $16,951.32 in interest fees! Wow. After 10 years, I finally paid it all off this month!

Now that I look at the total amount I paid and seeing what I did, there are some things I should have done differently –and better, if I had to do it all over again. If you are graduating soon or have already graduated with thousands of dollars in student loan debt, I hope that reading this blog post will help you to accomplish paying off your own student loan or at least motivate you to make better decisions now to help you become debt-free in the future.

For the longest time I felt I had this huge burden on my shoulders that I would never be able to lift. Like I dug myself so deep that it would be hard to get out. The worst part is no one really talks about it because everyone thinks its the norm or that it’s acceptable. For me, it’s no longer far from reach. I have made a conscious decision to live a financially free life. Had I realized this years earlier, I wouldn’t be working so hard now. I use to wake up every morning wondering why I was working so hard. Really, it was because I had built this gigantic snowball of debt that I was trying to pay off. At one point, I worked three different jobs at the same time. I worked over time, holidays, vacations; from morning to night with little to no sleep. I had no time to spare for my young children and they were growing so fast. My daughter often asked me, “Mommy, why are you always working at your computer?”

Even my accountant asked me at one point, why I could not save a penny when my husband and I combined made a decent amount of money the previous year? I told her it’s because I felt like I had so much debt to pay that I couldn’t save that money. It’s so true. Every penny I made went to raising my children, groceries, paying two car loans, a home mortgage, auto insurance (because we live in Metro-Detroit, I’m pretty sure we have one of the highest premiums in the country) and the biggest chunk: credit card debt and student loan debt.

If I had to do it all over again, what I would do differently is to be more aggressive about paying off my student loan while I was still in school (and single, with no kids!). I took my good old time and I only paid the minimum payment each month starting from the following month that I graduated.

Even during my 4 years in college, I could have put $100-$200 toward the balance of the loan. Instead, I waited 4 years! My number one advice to you –if you’re trying to pay off your own loan, start paying it the minute you walk out of the financial aid office!

When I do the math: At $35,384.44 I could have paid $2,948 per month for 1 entire year and paid it off (not including interest) entirely. That is obviously a bit extreme and not realistic. So, what if I took 3 years to pay it off? I would have paid $982 per month (not including interest) for 3 years. This is more realistic even though it’s still pretty advantageous because who has $982 lying around each month?

Instead of aggressively paying the loan, I took 10 years and paid at minimum, $292 per month. I didn’t really realize the power of paying more in the beginning and instead, just paid the minimum balance. It wasn’t until the past 2 years did I begin to aggressively pay more per month. Some months, putting $3,000-$6,000 toward the balance. This is when I started to see results. The balance started to go down. I became more motivated and excited that I could really pay this off!

I’m not going to lie: Some days after I paid that much, I panicked thinking about the lack of money in our emergency fund and retirement (pretty much, non-existent) and what we would eat that month. It was extremely hard, nerve-wrecking, downright sad! There were days that I just cried thinking about the huge burden and how I worked so hard, so many hours, so many different jobs just so I could be, broke.

Some small things we did to cut down on our monthly budget in order to pay more on my student loan: eating in more, eating leftovers, couponing, hustling for deals, wearing thrifty clothes, living off gift cards and referral credit, selling the kids toys, clothes and electronics. Every penny we earned or saved added up to a few hundred dollars that we were able to put toward my student loan. If we had a tax refund at the beginning of the year, it went straight into paying the loan!

Here are 3 practical tips I have for you if you want to pay off your student loan:

- Start paying the moment you borrow. The day you walk out of that financial aid office, start making plans to find a part-time or full-time job while you attend school to pay the debt immediately. For example, with credit cards, the companies and others will tell you: You want to pay the balance in full each month to avoid interest the following month. If you’re able to use this same concept and keep the mindset of paying in full each month, this will give you a sense of urgency when paying your student loan –even if the financial advisers tell you that you have until after graduation to pay it.

- Create a realistic bottom-line budget for yourself (and your family). What’s the minimum amount of money you need each month to survive? Your goal in setting a realistic bottom-line budget is to find extra money left over that you can put toward your student loan debt, even if you’re already paying the minimum. Always try to pay more. Want to see what my monthly budget work sheet looks like? Click here to download it!

- Automate your payments. Once you find the extra money from your budget, automate the payment. If you’ve already graduated: You should also automate your minimum payment. Often times, the loan companies will give you a discount for doing this part. On a side note: If you’re not getting a discount for auto payments, it’s time to give them a call and request one!

Here are a 10 things you can do to save more money per month to put toward your loan:

- Buy meat in bulk because the cost is cheaper per pound. Cut and portion it out into freezer-grade gallon plastic bags. Freeze your portioned meat to keep it from going bad. This meat should last you at least a month if not more!

- Eat out less. If you need to eat out, try a discount service like Restaurants.com or get an Entertainment Book and only eat out from the places where you can utilize coupons and discounts.

- Ask kindly for gift cards during birthdays, Christmas or special holidays and events. Your family and friends love you. They want to help. Don’t be afraid or ashamed to kindly ask for gift cards to your favorite stores like Walmart, Target, Kroger, and Amazon. We received several gift cards this way instead of gifts or toys that the kids might never use or already have. The gift cards went toward groceries or essential clothes/accessories for the kids including new socks, underwear, shoes (things that you don’t really want to buy used!) Don’t have a lot of friends or family members who can gift at all? Try buying discount gift cards when you do have to shop for anything. Raise.com does an excellent job of carrying all kinds of gift cards for big retailers like Target and Walmart. Use the coupon code SDEALS to get $5 off any discount gift card.

- Sell your used items on free apps like Poshmark (use my invite code MRSKUE when you sign up and get $5 off your first purchase) If you’re thinking about throwing something away, why not check out these free apps first to see if someone might buy it off of you?

- Spend 1 hour per month printing coupons and sorting them: Don’t have a lot of time or patience for couponing? I challenge you to try and carve out just 1 hour per month to find and clip essential coupons from. Most coupons expire at the end of the month and new coupons pop up around the same time so finding a date –like the 1st or the 31st to print coupons is a great way to save money and time! Only print the coupons for the products that you use or know that you will buy!

- Join a referral company and refer your friends to get store credit or other free perks! Use your referral credit to score essential items that you would normally have to pay full-price!

- Sign up for legit survey and gift card reward companies like Swagbucks

- Grow your own herbs or vegetable garden. Is there an herb that you always use in your dishes or a vegetable that your kids can’t seem to get enough of? Try growing the vegetables so that you have plenty of them. You can start an herb garden indoor and grow herbs like Basil, Cilantro, Mint, Green Onion. During the spring, plant your own corn, tomatoes, green beans and cucumbers. Did I mention, we have a peach tree and a pear tree in our backyard? When September rolls around, I look forward to canning, baking and eating FREE fresh fruits every day! Planting a peach tree is actually pretty easy. Go to your local Lowes or Home Depot during the spring time to find them in stock.

- Look for free events and meals for your kids. During the summer months, our local schools have a program where kids can go and eat lunch for free! This helps cut grocery costs and gives the kids something different to do instead of being couped up inside!

- Compare prices and shop online for non-perishable grocery food items. Before you buy anything, always compare the price to online retailers and don’t underestimate the power of online shopping! I can’t tell you how many people I run into that pay retail price at their local grocery stores and don’t think twice about it! When they ask me how do I save on bulk snack foods, drinks and household products, I usually refer them to Amazon or Jet.

Amazon has an amazing program where you can subscribe to 5 items per month and save 15% across all 5 items! Even better, if you buy baby products, you’ll get 20% off! When stacked with sale prices, these savings add up real quick.

Jet allows you to add items to your cart and you can watch the price drop in pennies.

10 years and 3 kids later (all under the age of 5), I realized what a huge mistake I made in my personal finances. This is something I never want my children to have to go through. If they can learn from my mistakes, I would rather them do so than to experience it like I did.

I hope you’ll be able to use my tips found here and to not make the same mistake that I did! If you’re interested in seeing what my monthly budget worksheet looked like, click here to access the file and it download it for your own use.